Beyond The Headlines

CAPITULATE OR “PERSEVERATE”?

In a comment on my recent paper (Picking daisies under a fuming volcano, 11/30/2017) a European colleague with some affinity for our investment style nevertheless reminded me that “for us, asset managers, timing is of the essence” and that “clients will resent our missing another year of rising markets.”

This warning was sent before the recent rout in the global stock markets, but it does not affect my strong views on the difference between short-term and long-term investing.

There is no indication that measuring performance over shorter-term periods — as do many consultants, boards of trustees and others without their own money on the line — would produce superior long-term results. As Joe Wiggins, who is responsible for running a range of multi-asset fund of funds at Aberdeen Standard Investments, writes in his blog Behavioural Investment (1/31/18):

“It is not only that headline performance consistency is a deeply misleading means of assessing the ability of an active equity manager, but as a characteristic, it is the exact opposite of what fund selectors should be seeking. By definition, long-term … conviction investors will not deliver performance consistency over the short-term. There will be periods (often prolonged) when their style is out of favor and the ‘market’s perception’ diverges materially from their own. Through such spells of challenging performance, we should expect them to remain disciplined and faithful to their philosophy and approach; not wish them to latch onto the latest market fad in an effort to achieve improved short-term returns.

Consistency is absolutely paramount to the assessment of active equity managers, but we are focused on the wrong sort of consistency. Rather than obsess over the persistence of short-term outcomes; we should focus our attention on the consistency of manager behavior relative to their stated philosophy.”

This being said, I do not need to be reminded of clients’ occasional impatience with idle cash, especially in ebullient markets. I launched the Tocqueville Fund in January 1987, when still under the auspices of Tucker Anthony/John Hancock. Since my partner and I were relatively unknown to the public and we did not do any marketing, the few early investors were mostly traders and brokers of Tucker Anthony, who had known and followed me for more than a decade.

1987, John Authers points out in the Financial Times (1/26/18) was the last time the S&P started a year as strongly as it has this year. But, in early 1987, I was already very wary of the stock market because of valuation, some signs of economic slowdown and fallacious promises of “portfolio insurance” through derivatives. Much of the early inflow into the Tocqueville Fund thus stayed in cash.

Until that is, I began receiving phone calls from my friendly investors pointing out that, if they had wanted to own a money market fund, that was what they would have bought! So, I yielded and invested most of the Fund’s cash only weeks before Black Monday (October 18, 1987). By the end of October, the US stock market was down almost 23%, with several foreign markets faring even worse.

In the past, bear markets associated with economic recessions suffered even greater, and usually longer, declines. In this case, the US economy never fell into recession and 1988 was an excellent year if you had the cash to invest. In fact, by early 1989, the market was back to its pre-crash high — though many professionally-managed portfolios were not.

As I write this, the ranks of pessimists among investors have been shrinking fast.

Some have simply joined the index-hugging crowd under cover of politically-dictated arguments: economic stimulus from tax cuts, short-term budgetary help from the repatriation of accumulated foreign profits, empowerment of business through reduced regulation, and promised huge infrastructure programs. There are as many reasons to doubt as to believe the validity of these arguments but for the moment, the arbiter seems to be the stock market. In fact, what this group of optimists really believes is that stocks should continue to rise because they have been rising.

More intriguing is the “temporary” capitulation of a (much smaller) number of estimable, historically successful investors. These longer-term investors usually subscribe to Ben Graham’s definition that, in the long run, the market is a machine that weighs fundamentals, but that, in the short run, it is merely a voting machine.

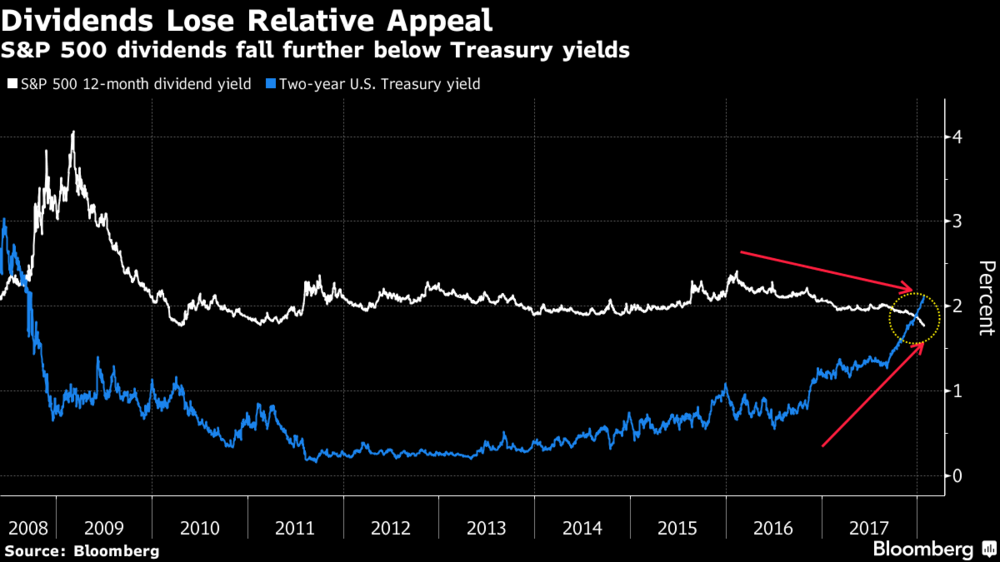

These elite investors do believe in fundamental analysis but recognize that recently, central banks have prodded, first the US market and now most advanced economies’ markets, with artificial, excess liquidity (ZIRP, QE, etc.). As a result, with quality bond yields and sometimes even junk-bond yields hovering around zero, we have been in a TINA — There Is No Alternative (to stocks) — environment. That era may be coming to an end (see chart below), but until central bankers are absolutely sure, they may continue to flood the stock markets with excess liquidity – an attitude that might be reinforced by the recent mini-correction.

Many investors are well aware that current valuation levels call for sub-par results from equities over the next decade. A number of models illustrate the link between asset valuations at the beginning of a decade and the return from those assets in the following ten years: GMO, Oaktree, Crestmont Research, John Hussmann and of course Nobel Laureate Robert Shiller’s CAPE (Cyclically Adjusted Price/Earnings).

These models never were intended to become timing tools but, rather, mere indicators of likely average future returns over long periods. Yet the longer their warnings have been calling for sub-par future returns in the face of rising markets, the more criticism (of one aspect or another) of these models has proliferated.

Fortunately, a report published this month by Robert D. Arnott, chairman of Research Affiliates LLC, with his team, dismisses most of these critiques. (1) Research Affiliates specializes in quantitative investing. They have thoroughly studied how various investment styles and selection criteria work over time, and currently advise over $160 billion of institutional investment assets (2015). So, when they claim that “It’s NOT different this time”, it is worth paying attention.

On the other hand, given the global economic recovery, no signs of imminent economic trouble and ample central bank liquidity, several of the sophisticated investors mentioned above have been considering the possibility of a market “melt-up.” As its name implies, this would be the opposite of a meltdown: a bubbly last hurrah of the long bull market that started in 2009.

I cannot entirely discard this possibility but I believe that stock markets now are mostly in their “voting machine” mode. In other words, they depend almost entirely on the psychology of crowds.

In many ways, the 1987 crash was what Nassim Nicholas Taleb later famously labeled a Black Swan: an event that is rare, has an extreme impact and, because it has never happened before, is hard to anticipate. So, a Black Swan may be waiting for us around the corner. Yet comparably rare events are mostly called Black Swans by those who failed to anticipate them or at least failed to protect themselves against their possibility.

If we leave aside “end-of-the-world” scenarios such as nuclear war, or the most obvious areas of blind greed and speculation such as bitcoin, the best way to protect ourselves financially is to heed the warning of Hyman Minsky. He observed that economic and financial stability leads to instability without the need for an external trigger, simply by making people more complacent and more willing to accept risk through the imprudent use debt.

Two obvious areas where complacency and increasingly blind risk acceptance have become the norm since the Great Recession (2007-2009) are:

- Interest rates They have been “suppressed” (kept artificially low) by central banks, giving consumers and businesses the false impression that their actions are essentially riskless. As one example, the yield spread of junk bonds over Treasuries has shrunk to the point where investors may no longer be compensated for the additional risk they incur by buying “junk.”

- Stock market valuations Are they merely high, or unsustainably so? It depends where. In some areas of the markets, the answer is obvious. David Stockman, director of the Office of Management and Budget under President Reagan, made the point eloquently in the Daily Reckoning (8/1/2017). He pointed out that in the 31 months between January 2015 and August 2017, the weighted P/E (price/earnings ratio) of the so-called FAANGs + M (Facebook, Apple, Amazon, Netflix, Google and Microsoft) increased by some 50%!

The total market capitalization of the S&P 500 rose from $17.7 trillion to $21.2 trillion. The six FAANGs + M accounted for 40% of the entire gain, meaning that the market capitalization of the other 494 stocks only rose from $16 trillion to $18.1 trillion — only 13% in 31 months vs the 82% gain of the six super-momentum stocks. If that is not a bubble, I don’t know what is!

The irony, of course, is that by imposing as benchmarks indexes that contained these heavy-capitalization stocks, consultants, directors, and trustees forced many money managers to buy more of these expensive stocks as they became ever more expensive. Naturally the reverse dynamic will come into play when the stock market ultimately declines.

* * * *

It is our belief that an advisable policy at this juncture is to look for investment opportunities among the less-inflated segments of the global markets. This is where we are searching for new ideas. Meanwhile, having maintained adequate cash reserves will allow us to seize these opportunities as they arise.

At the same time, one of the rules for making money over time is, first, to avoid losing it. When markets decline, it is hard to escape the outgoing tide altogether. But we hope to minimize losses by avoiding the idolized and overpriced favorites of the preceding advances, as well as steering clear of companies that have burdened themselves with excessive or unnecessary debt (to buy back their own shares, for example).

“Over the years, Institute research has shown active managers, even the best-performing ones, suffered periods of weak returns relative to benchmarks and their peers. But underperformance, up to three years, had relatively little impact on the best-performing funds’ ability to deliver success over 15 years… We think that underperformance in shorter periods—such as one quarter, one year, and perhaps even a few years—can be a normal part of the investment experience, even for funds that perform well over longer periods.”

The Brandes Institute, September 2014

François Sicart – 2/6/2018

(1.) CAPE Fear: Why CAPE Naysayers Are Wrong – Research Affiliates – January 2018

Disclosure:

This article is not intended to be a client‐specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This report is for general informational purposes only and is not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally.